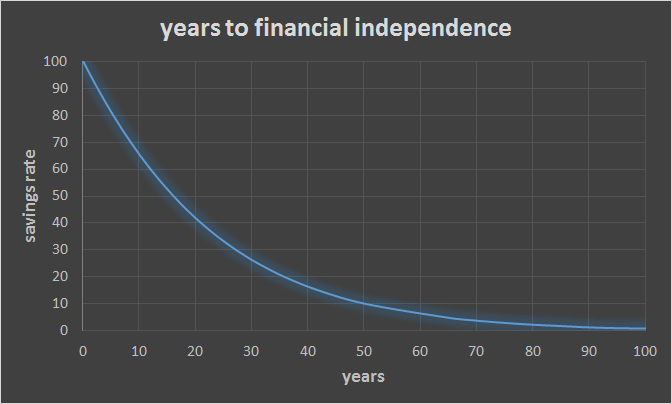

Researchers at Morningstar peg the safe withdrawal rate at somewhere between 3.3% and 4%, accounting for factors such as relatively low yields in the bond market and relatively high valuations on stocks (which tend to dampen future returns). Returning to to Sabatier's earlier example, if you intend to spend $40,000 a year in retirement, divide by 0.04 to get to your million dollars.Īs Sabatier points out, some more recent studies suggest it may be wiser to aim for a lower withdrawal rate if you're hoping for an extended retirement. When calculating your FIRE number, remember that the multiple of 25 is really just an easier way of dividing by a 4% withdrawal rate. "But thankfully, the updated calculations now show that you can live off between 3.5% and 4% of your money" and your portfolio will likely continue to grow over the decades. "Unfortunately, that was a 30-year timeframe, and most early retirees today need their money to last 30 to 50 years," says Sabatier. The conclusion: In 99% of cases, retirees could withdraw 4% per year, adjusted for inflation, from a portfolio of stocks and bonds without running out of money. The FIRE number calculation is rooted in the so-called "4% rule," which was popularized in an influential 1998 research report known as the "Trinity study." Included in the research was an examination of past market performance to determine a safe withdrawal rate in retirement. The math behind the FIRE number calculation Here's what retirement experts say you need to know to figure out how much money you'll need to retire.

"This million dollars essentially is how much money you need to reach financial independence and live off that amount of money for the rest of your life."Īs with any other one-step financial calculation, the FIRE number math is based on several assumptions and will vary based on your financial situation.

"Meaning if you spend $40,000 a year, multiplying that $40,000 by 25 would get you to a million dollars." "Your FIRE number is the amount of money you need to live on for the rest of your life," says Grant Sabatier, creator of financial site Millennial Money and the author of "Financial Freedom."įor many aspiring early retirees, calculating that number comes with an easy shorthand: "The way you calculate your FIRE number is multiplying your expected annual expenses by 25x," says Sabatier, who reached financial independence at 30. For adherents to the financial independence, retire early, or FIRE, movement, that figure is much more concrete.

0 kommentar(er)

0 kommentar(er)